Is Something New Cooking up in the Food Tech Industry?

-- 2019 blog post, replicating here in its new home --

Just within a weeks time, I read / stumbled upon two interesting articles on the startup ecosystem. One that said “Move Over Amazon & Flipkart. Social Commerce is the next big thing” highlighting the recent advances or say changes to the business models of online commerce from the traditional e-commerce business model. The other talked about “New Business Models in the Fin-tech Industry 2020 & beyond”. And then we have Lambda School, probably the mother of all New Business Models disrupting the entrenched education system that has little changed in the last 500 years!

This coincidence, of sorts, piqued me and began to wonder if there was something like this, a cool new business model was brewing in the “Food Tech” industry. After E-Commerce, Fin-Tech, Ed-Tech and Food Tech have been the biggest startup headlines grabbers in India for the past decade or so now.

First Ever Tomato Ketchup was invented back in 1812

Food Tech is, by now, a common buzz word in the startup galore. If you take a step back and look at it, technology has played a prominent role in shaping food, agriculture and diet for more than a century, perhaps ever since the first Tomato Ketchup was invented back in 1812

Time flies fast, technology changes even faster and by 2019 we have a whole new meaning for “Food Tech”. In fact there are more than one, in fact tens, of meaning of what it means by “Food Tech”. From power drinks to healthy food processing units to “Fake Meat” to AI powered Smart Kitchen appliances to Food Delivery apps — all are tagged / branded as “Food Tech”.

To put it in perspective, one can say “Food Tech” is the worlds largest industry, with a loyal customer base of 7+ Billion people — everybody has got to eat.. :-)! The World Bank estimates that food and agriculture comprise about 10% of the global GDP, meaning that, food and agriculture would be valued at about $8 trillion globally based on the projected global GDP of $88 trillion for 2019.

Consumers today are juggling hectic work and personal lives, and demand convenience when it comes to their meals. Today, in India particularly, grocery ordering and delivery represents the largest food tech category. Meal ordering comprises the greatest number of privately held, venture-backed startups in food tech globally. 2018 was an exceptional year for food tech, with a record-breaking $16.9 billion in funding recorded. According to Crunchbase, the three biggest deals of the year included $1 billion for Swiggy, India’s leading online restaurant marketplace; $600 million for Instacart, a U.S. grocery delivery service; and $590 million for iFood, a Brazil-based restaurant marketplace.

While all this paints a rosy picture on one hand, then there is also this other side of story — with “All That Glitters Is Not Gold”

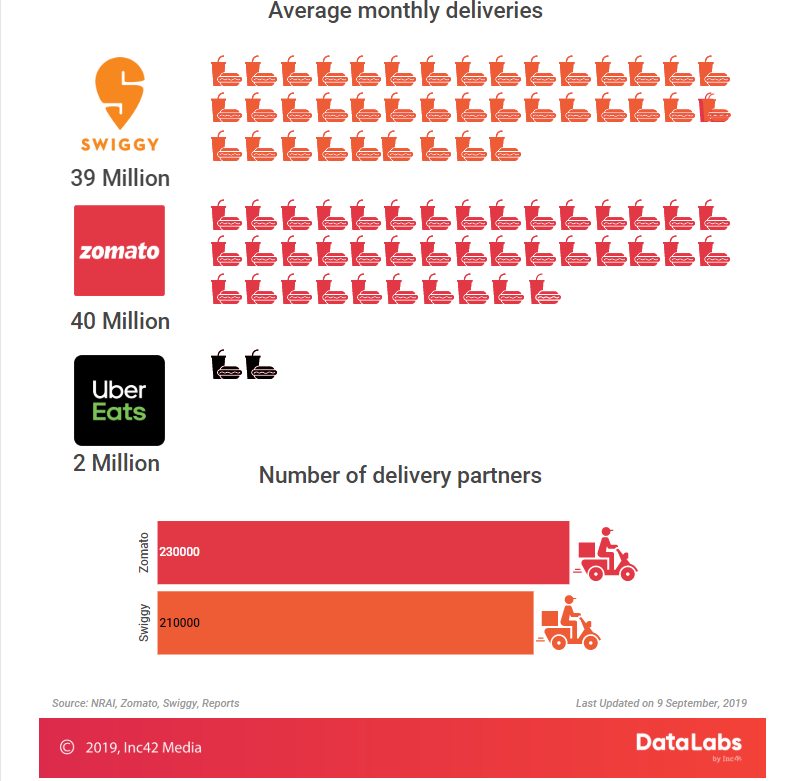

If you dig a little deeper, the traction numbers are pretty staggering.

Image credits to Inc42 / DataLabs. Merely copy pasting here.

By sheer numbers, Indians are gobbling up food and are quite interested in getting food delivered to the door steps. However, even with all these numbers the sky high, the unit economics aren’t that rosy for pretty much two key parties involved in this business — The Restaurant, The Delivery Aggregators and The Customer. As you can all imagine, clearly the customer has been the biggest beneficiary of this grand scheme of business.

But then, at what cost?

Image credit to Inc42 / Data Labs. Copy Pasting here with back reference links

The net profit margin increase for a standard restaurant operating an outlet is only between 3–5% although his top-line revenue growth has been 30–40%.

This huge asymmetry in earnings to revenue ration throws in cold water to the euphoria of “food delivery aggregators” among the industrious, hard-working restaurant owners.

It is not without reason, the recent #logout campaign had gained nationwide talking points and hogged media for a while that the well-funded startup had to get on table with the Restaurant Associations to hash it out amicably.

It is important to note that these delivery aggregators aren’t really basking in the glory of gold either. All of the startups are burning money like never before with every passing day. All of these food delivery startups have reported increasing quarterly losses with the increase in orders and expansion plans.

So where does all this money go anyway..??!

Where does all this money go anyway??!!

One Word — CAC or Customer Acquisition Cost.

CAC is the biggest source of dollar spend that each of the major players splurge to gain the attention of customers and to make them coming back again and again!

This essentially encompasses all from — marketing ads, steep discounts, to brand promotions, to exclusive deals with marquee restaurant brands.

And again the question remains — But at what cost?

If the two of three entities involved in business process isn’t benefiting, then the 800 pound gorilla in room is asking questions like — Is this for real? Is this going to work long term? Is this sustainable?

This almost begs the question — Can’t we do better? Isn’t there any other alternative to this?

It almost feels like there should be an alternative. I am not talking about alternative startup who would do this cheaper, bigger & better or leaner, but I am talking about perhaps a strategically different business model that can work out most, if not all, the edges of the 1.0 of Food Tech industry, which is currently in the limelight.

I am sure someone, somewhere is cooking something on these lines!